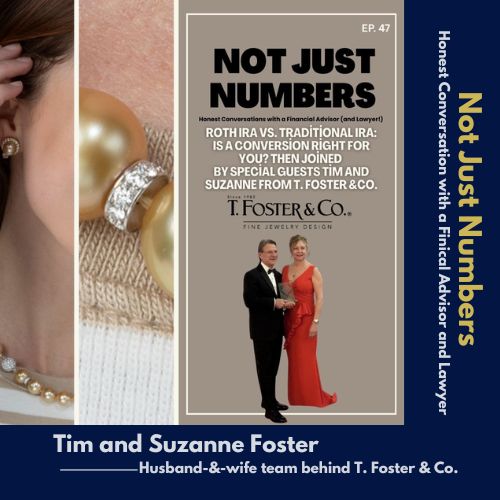

Episode 47: -Roth IRA vs. Traditional IRA: Is a Conversion Right for You? Then joined by Tim and Suzanne from T. Foster & Co.

Hosts: Madison Demora and Mike Garry

Special Guests:Tim and Suzanne Foster -Husband-&-wife team behind T. Foster & Co.

Episode Overview

Listen to Our Podcast On:

TIMESTAMPS

00:08 – 01:18 – Introduction to episode topic: Roth Conversions

01:19 – 03:33 – What is a Roth IRA: Differences between Roth IRA and traditional IRA

03:34 – 04:16 – Roth Conversions and How They Work

04:17 – 08:36 – Factors to Consider Before Converting

08:37 – 09:28 – Best Timing for Roth Conversions

09:29 – 11:27 – How Much Should You Convert?

11:28 – 11:45 – Tax Implications of Converting to a Roth IRA

11:55 – 48:26 – Interview with Tim and Suzanne from T. Foster & Co.

Connect with our Special Guest

Follow Us on Social Media

Stay updated with the latest episodes and news by following us on social media: