Episode 17: Revenge of the boomers featuring Dan McLaughlin from Yardley Refillery

Hosts: Madison Demora and Mike Garry

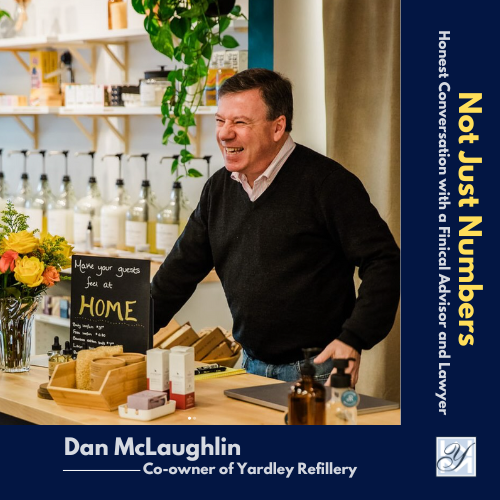

Guest: Dan McLaughlin Co-Owner Yardley Refillery

Episode Overview

In Episode 17 of Not Just Numbers, Madison Demora and Michael Garry, founder and CEO of Yardley Wealth Management, discuss the risks baby boomers face with their retirement savings, particularly with target date funds (TDFs). The episode delves into the challenges of TDFs, such as their often-risky investment compositions and the growing concerns among retirees about safeguarding their financial futures. The conversation also highlights insights from Dan McLaughlin, co-owner of Yardley Refillery, on sustainable shopping and its benefits to the community.

Listen to Our Podcast On:

Timestamps

- 00:09 – 02:32 – Introduction to episode topic: Revenge of the Boomers?

- 02:33 – 08:28 – Historical Context and Evolution of Retirement Savings

- 08:29 – 13:01 – Target Date Funds: Structure, Risks, and Impacts

- 13:02 – 15:47 – Awareness of Risks and Role of Plan Sponsors

- 15:48 – 18:24 – Recommended Actions and Importance of Retirement Planning

- 18:33 – 01:01:17 – Interview with Dan McLaughlin from Yardley Refillery

Connect with our special guest

Follow Us on Social Media

Stay updated with the latest episodes and news by following us on social media: