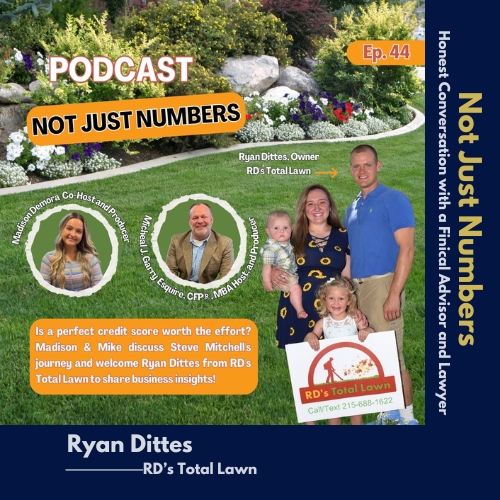

Episode 44: The Pursuit of a Perfect Credit Score – Is It Worth It? Then joined by Ryan Dittes from RDs Total Lawn

Hosts: Madison Demora and Mike Garry

Guest: Ryan Dittes, the owner of RDs Total Lawn

Episode Overview

In this episode of Not Just Numbers: Honest Conversations with a Financial Advisor and Lawyer, Madison and Mike discuss the fascinating story of Steve Mitchell, a Texas engineer who became determined to achieve a perfect 850 credit score. They explore Mitchell’s journey, the strategies he used, and whether perfection is truly necessary when it comes to credit scores. Mike shares the importance of responsible credit habits, and when focusing on your score can become counterproductive.

Tune in for practical advice on maintaining strong credit while keeping your financial health in perspective. Later in the episode, they are joined by Ryan Dittes, the owner of RDs Total Lawn, a lawn care business dedicated to exceptional customer service, employee development, and growth. Ryan shares insights on building a business that thrives through strong communication, reliability, and a focus on long-term success.

From managing the challenges of a seasonal industry to fostering a positive company culture, we explore the core values that drive RD’s Total Lawn. Join us for a candid conversation about the keys to running a successful business while prioritizing customer care, team development, and sustainable growth.

To read the WSJ article mentioned in the podcast click here

Listen to Our Podcast On:

TIMESTAMPS

00:08 – 02:37 – Introduction to episode topic: The Pursuit of a Perfect Credit Score -Is It Worth It?

02:38 – 05:56 – Mike’s take: Is Perfectionism Necessary for Credit Scores?

05:57 – 06:43 – Should Credit Bureaus Be More Transparent?

06:44 – 09:55 – Is Striving for a Perfect Credit Score Worthwhile? Key Considerations

09:56 – 11:10 – Do Credit Monitoring Apps Influence Positive Financial Behavior?

11:11 – 12:10 – Habits for True Financial Well-Being

12:18 – 54:40 – Interview with Ryan Ditties from RDs Total Lawn

Connect with our special guest

Facebook

Instagram

Website

YouTube

Follow Us on Social Media

Stay updated with the latest episodes and news by following us on social media: