Episode 9: Financial Planning with Certificates of Deposit (CDs)

Hosts: Madison Demora and Mike Garry

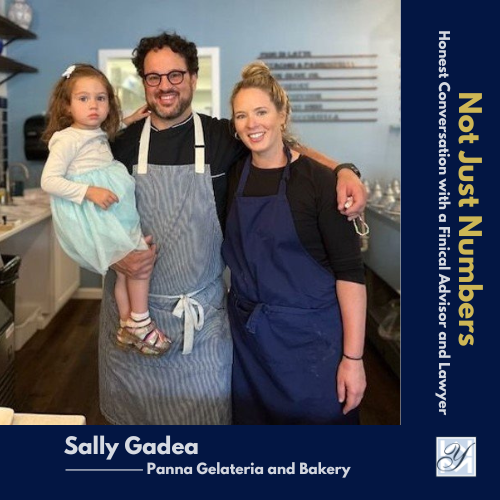

Guest: Sally Gadea, Owner of Panna Gelateria and Bakery

Episode Overview

Join Madison Demora and Mike Garry as they delve into the benefits and strategies of Certificates of Deposit (CDs) in the current economic climate. They also discuss the implications of an inverted yield curve and feature an inspiring success story from a local business owner, Sally Gadea of Panna Gelateria.

Listen to Our Podcast On:

Key Points and Timestamps

- 00:00 – 05:00: Introduction to CDs and their benefits

- 05:01 – 15:00: Laddering strategy for CDs

- 15:01 – 25:00: Navigating an inverted yield curve

- 25:01 – 35:00: Interview with Sally Gadea from Panna Gelateria

In-Depth Analysis: Benefits of Certificates of Deposit (CDs)

Mike Garry provides a comprehensive analysis of why Certificates of Deposit (CDs) are a viable low-risk investment option, especially in a rising interest rate environment. He elaborates on the laddering strategy, which helps investors maximize their returns by spreading investments across multiple CDs with varying maturity dates.

Garry also addresses the challenges posed by an inverted yield curve and offers insights on how to navigate this unique economic scenario. By comparing short-term high-yielding CDs with long-term bonds, he helps investors make informed decisions that align with their financial goals.

Guest Spotlight: Sally Gadea’s Success Story

Sally Gadea, the owner of Panna Gelateria and Bakery, shares her entrepreneurial journey. Opening a business during the pandemic presented significant challenges, but with determination and support from the local community, Panna Gelateria has thrived. Sally highlights the importance of offering high-quality products and building genuine connections with customers.

Connect with our special guest

Facebook

Instagram

Website

LinkedIn

Follow Us on Social Media

Stay updated with the latest episodes and news by following us on social media: