Episode 4: Maximizing Your Investments and Savings with Smart Financial Choices

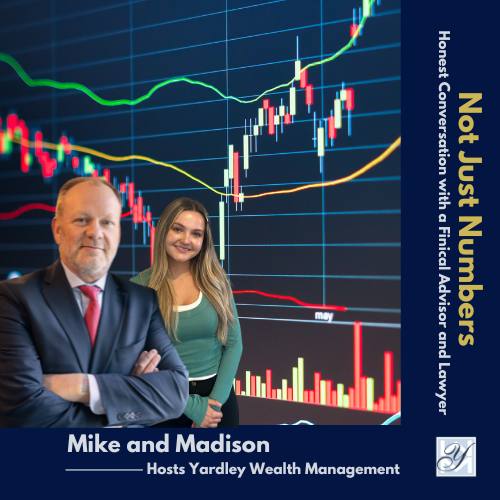

Hosts: Madison Demora and Mike Garry

Episode Overview

Episode 4 Overview: Free Money, Investing, and Smart Financial Planning

In this episode of Not Just Numbers, Madison Damora and Mike Garry discuss essential financial strategies, including asset allocation, the differences between mutual funds and ETFs, and how to optimize savings with high-yield accounts. Mike also shares valuable tips on avoiding common banking pitfalls and making smarter, tax-efficient investment decisions. Tune in for practical advice on managing your money and maximizing returns.

Listen to Our Podcast On:

Key Points and Timestamps

- 00:11-00:45 – Introduction

- 00:46-05:16 – Our Investment Process

- 05:17-13:08 – Mutual Funds and ETFs

- 13:09-26:40 – Episode Topic of Discussion: FREE Money! Savings Strategies

Follow Us on Social Media

Stay updated with the latest episodes and news by following us on social media: